Atal Pension Yojana (APY) in 2023: How to Apply, Check Eligibility, Benefits, Age Criteria, Documents required, Opportunities, Official Website & Toll Free Number (अटल पेंशन योजना (APY) 2023 में: आवेदन कैसे करें, पात्रता की जाँच करें, लाभ, आयु मानदंड, आवश्यक दस्तावेज, अवसर, आधिकारिक वेबसाइट और टोल फ्री नंबर की जांच करें।)

Atal Pension Yojana (APY) was launched by the Government of India on May 9, 2015. It is a social security scheme aimed at providing a fixed pension to individuals in the unorganized sector. The scheme is named after the former Prime Minister of India, Atal Bihari Vajpayee. APY focuses on ensuring financial security for individuals during their old age.

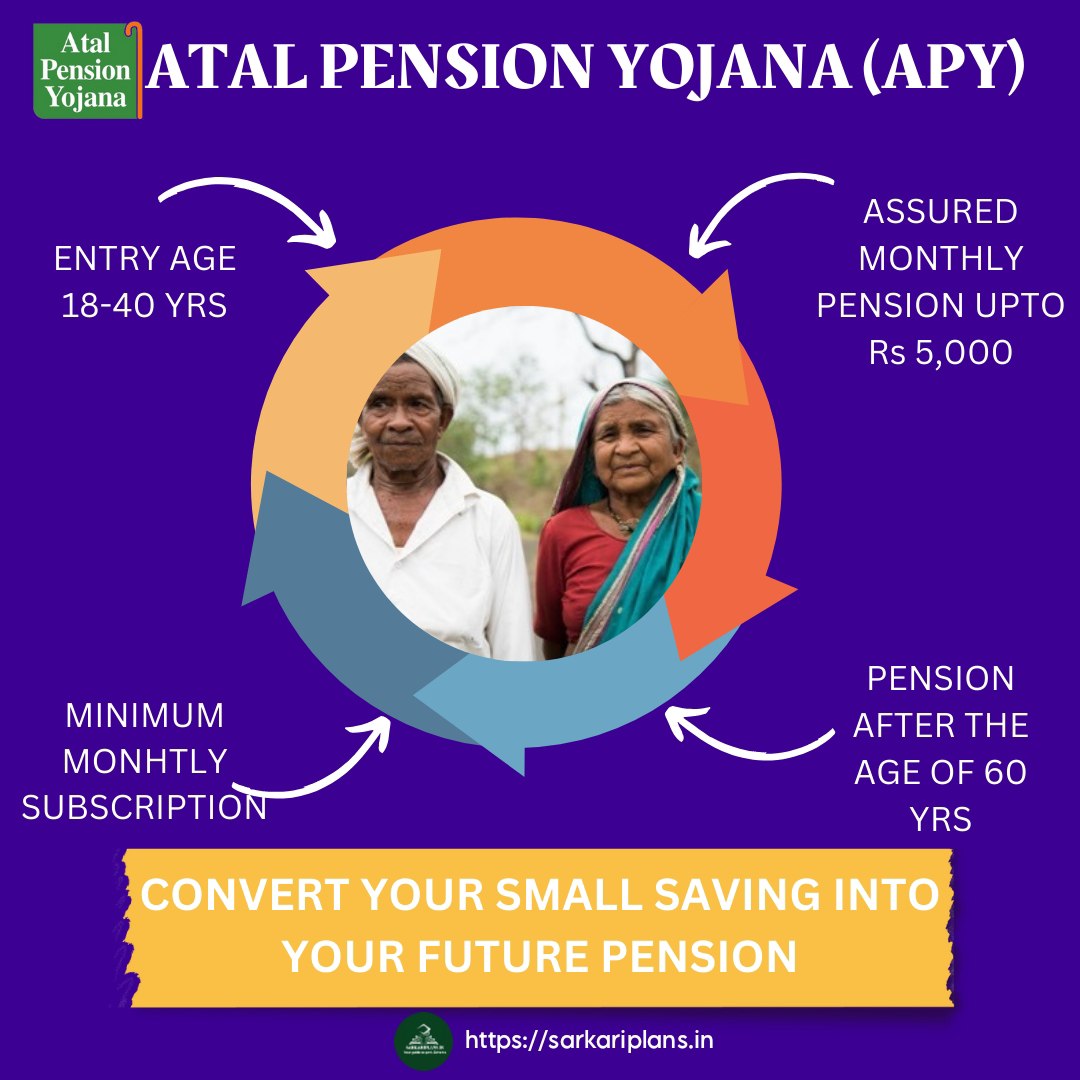

Atal Pension Yojana

Atal Pension Yojana (APY) is administered by the Pension Fund Regulatory and Development Authority (PFRDA). It encourages workers in the unorganized sector to voluntarily save for their retirement and offers a guaranteed minimum pension ranging from Rs. 1,000 to Rs. 5,000 per month, depending on the contribution and the age of the subscriber.To be eligible for the Atal Pension Yojana, individuals must be citizens of India and fall within the age group of 18 to 40 years. The contributions towards the pension are based on the age of entry, the chosen pension amount, and the contribution period. The scheme provides a co-contribution by the government for eligible subscribers, particularly those belonging to economically weaker sections. APY encourages individuals to voluntarily save for their retirement by contributing to a pension fund during their working years. The scheme aims to ensure financial stability and security for the beneficiaries during their old age.

Key points of Atal Pension Yojana

| Scheme Name | Atal Pension Yojana |

| Launched By | Government Of India |

| Implementation Date | 09 MAY 2015 |

| Beneficiaries | Indian citizen within the age group 18 to 40 |

| Pension | Rs. 1000/- to Rs. 5000/- Per month |

| Application Process | Offline |

| Official Website | https://www.npscra.nsdl.co.in |

| Toll-free Number | 1800-889-1030 |

Benefits of Atal Pension Yojana

The Atal Pension Yojana (APY) offers several benefits to individuals in the unorganized sector:

1. Guaranteed Pension: APY provides a guaranteed minimum pension amount ranging from Rs. 1,000 to Rs. 5,000 per month, depending on the contribution amount and the age of the subscriber.

2. Financial Security: The scheme aims to provide financial security and stability to individuals during their old age, ensuring a regular stream of income post-retirement.

3. Affordable Contributions: APY offers affordable contribution options based on the age of entry and the desired pension amount, making it accessible for individuals with varying income levels.

4. Government Co-contribution: The government provides a co-contribution for eligible subscribers, particularly those from economically weaker sections, thereby enhancing the effectiveness of the scheme.

5. Voluntary Participation: The scheme is open to individuals between the ages of 18 to 40, allowing voluntary participation and encouraging people to start saving for their retirement early.

6. Simple Enrollment Process: The enrollment process for APY is straightforward, making it easy for individuals in the unorganized sector to join the scheme.

7. Portability: Subscribers can easily transfer their APY account from one bank to another or from one location to another within the country, ensuring flexibility.

8. Tax Benefits: Contributions made towards APY are eligible for tax benefits under Section 80CCD of the Income Tax Act.

Latest Updates

People who can’t invest huge sums every month due to low earnings can accumulate good amount through investment as low as Rs 7 in Atal Pension Yojana. Know how is it possible

Any Indian citizen who is not a taxpayer and whose age is between 18 years to 40 years, can contribute to Atal Pension Yojana.

If you start investing in Atal Pension Yojana at the age of 18, you will have to invest only a small amount every month, and at the age of 60, you can get a monthly pension of Rs 5,000.

For that, you will have to deposit Rs 210 a month, which means you have to save only Rs 7 per day.

If you have missed the bus and are already above 18 years, we will tell you how much investment you need to make to get a monthly pension of Rs 5,000.

How much to invest to get Rs 5,000 pension

- Rs 228 per month at the age of 19 years

- Rs 248 per month at the age of 20 years

- Rs 269 per month at the age of 21 years

- Rs 292 per month at the age of 22 years

- Rs 318 per month at the age of 23 years

- Rs 346 per month at the age of 24 years

- Rs 376 per month at the age of 25 years

- Rs 409 per month at the age of 26 years

- Rs 446 per month at the age of 27 years

- Rs 485 per month at the age of 28 years

- Rs 529 per month at the age of 29 years

- Rs 577 per month at the age of 30 years

- Rs 630 per month at the age of 31 years

- Rs 689 per month at the age of 32 years

- Rs 752 per month at the age of 33 years

- Rs 824 per month at the age of 34 years

- Rs 902 per month at the age of 35 years

- Rs 990 per month at the age of 36 years

- Rs 1087 per month at the age of 37 years

- Rs 1196 per month at the age of 38 years

- Rs 1318 per month at the age of 39 years

- Rs 1454 per month at the age of 40 years

Eligibility Criteria

The eligibility criteria for the Atal Pension Yojana (APY) are as follows:

1. Age: Individuals who are citizens of India and fall within the age group of 18 to 40 years are eligible to join the Atal Pension Yojana.

2. Savings Account: Prospective subscribers must have a savings bank account. The savings account is used for the monthly auto-debit of the contribution amount.

3. Not Covered by Any Statutory Social Security Schemes: Individuals who are already covered by any statutory social security schemes are not eligible to enroll in APY. This includes individuals covered under the Employees’ Provident Fund (EPF) and any other pension scheme.

Application Process

To apply for the Atal Pension Yojana (APY), you can follow these steps

1. Eligibility Check

Ensure that you meet the eligibility criteria, which includes being an Indian citizen and falling within the age group of 18 to 40 years.

2. Choose a Bank or Financial Institution:

Visit your preferred bank or financial institution that is enrolled in the Atal Pension Yojana.

3. Fill the Application Form:

Obtain the Atal Pension Yojana application form from the bank. Fill in the required details accurately, including your personal information, nominee details, and contribution amount.

4. Provide KYC Documents:

Submit Know Your Customer (KYC) documents as per the bank’s requirements. This may include documents such as Aadhar card, PAN card, and proof of address.

5. Select Pension Amount and Contribution Period:

Choose the desired pension amount you wish to receive and the corresponding contribution period based on your age at the time of joining.

6. Submit the Application:

Submit the completed application form along with the necessary KYC documents to the bank or financial institution.

7. Set up Auto-Debit Facility:

Authorize the bank to auto-debit the specified contribution amount from your savings account. This ensures regular contributions to your Atal Pension Yojana account.

8. Receive Confirmation:

Once your application is processed, you will receive a confirmation and details of your Atal Pension Yojana account, including the PRAN (Permanent Retirement Account Number).

Age Criteria

The age criteria for individuals to join the Atal Pension Yojana (APY) are as follows:

1. Minimum Age: The minimum age for joining APY is 18 years.

2. Maximum Age: The maximum age for enrollment is 40 years.

Therefore, individuals who are citizens of India and fall within the age range of 18 to 40 years are eligible to participate in the Atal Pension Yojana. It’s important to note that the age of the subscriber at the time of joining the scheme determines the contribution amount and the pension amount they may be eligible to receive post-retirement.

Documents Required

To enroll in the Atal Pension Yojana (APY), you typically need the following documents:

1. Proof of Identity (Any one of the following):

– Aadhaar Card

– Passport

– Voter ID

– Driving License

2. Proof of Address (Any one of the following):

– Aadhaar Card

– Passport

– Voter ID

– Utility bills (electricity, water, gas, etc.)

3. Age Proof (Any one of the following):

– Birth certificate

– Passport

– SSLC/10th Standard Certificate

– PAN Card

4. Savings Account Details:

– You will need to have an active savings bank account. Provide the account details, including the account number and branch.

5. Nominee Details:

– Information about the nominee, including their name, relationship, age, and address.

It’s advisable to check with the specific bank or financial institution where you intend to apply for APY, as they may have additional requirements or specific procedures for documentation. Having these documents ready will streamline the application process and ensure a smooth enrollment into the Atal Pension Yojana.

Official Website & Toll Free Number

Official Website: You can find information about APY on the official NPS website: https://www.npscra.nsdl.co.in

Toll-Free Number: 1800-889-1030 (Operational from 9:00 AM to 6:00 PM on all working days)

Please note that website URLs and contact information can change, so it’s recommended to verify this information with the latest sources.

Opportunities of Atal pension Yojana

Simplified Processes:

Opportunity: Continuously work on simplifying the enrollment and contribution processes. Minimizing paperwork and streamlining administrative procedures can attract more individuals to participate in APY.

Enhanced Government Co-contribution:

Opportunity: Consider reviewing and increasing government co-contribution amounts to make the scheme more attractive, particularly for those with limited financial resources.

By capitalizing on these opportunities, the Atal Pension Yojana can further evolve and solidify its role in promoting financial security and retirement planning among individuals in the unorganized sector in 2023. The combination of government support, technological advancements, customized solutions, and collaborative efforts can create a more inclusive and effective pension scheme, benefiting a broader section of the population.

Conclusion

Atal Pension Yojana stands as a pivotal step towards providing financial security for millions in the unorganized sector. By encouraging savings and providing a structured pension system, the scheme aligns with the government’s vision of inclusive and sustainable development. As India progresses, initiatives like APY play a vital role in ensuring that the benefits of economic growth reach every stratum of society, especially during the twilight years of life.

FAQs

Q1. How much pension can one receive under APY?

Ans- The pension amount varies based on the contribution and the age of the subscriber, ranging from Rs. 1,000 to Rs. 5,000 per month.

Q2. What is the contribution period for APY?

Ans- Subscribers contribute to the scheme for at least 20 years before attaining the age of 60.

Q3. What is the government co-contribution in APY?

Ans- Government provides a co-contribution for eligible subscribers, particularly those from economically weaker sections, for a specified period.

Q4. How can I change my contribution amount or frequency?

Ans – The contribution amount and frequency (monthly) are fixed at the time of joining and cannot be altered later.

Q5. Is there a penalty for delayed payments?

Ans- Yes, a penalty is levied for delayed payments, and the account may be frozen if contributions are not made regularly.

Q6. How can I exit from APY before the age of 60?

Ans- Premature exit is allowed only in case of the death of the subscriber or in specific medical conditions.

Q7. What happens if a subscriber dies during the contribution period?

Ans- In case of the subscriber’s demise, the spouse or nominee will receive the pension. If the spouse also passes away, the accumulated pension corpus will be returned to the nominee.

Read more-